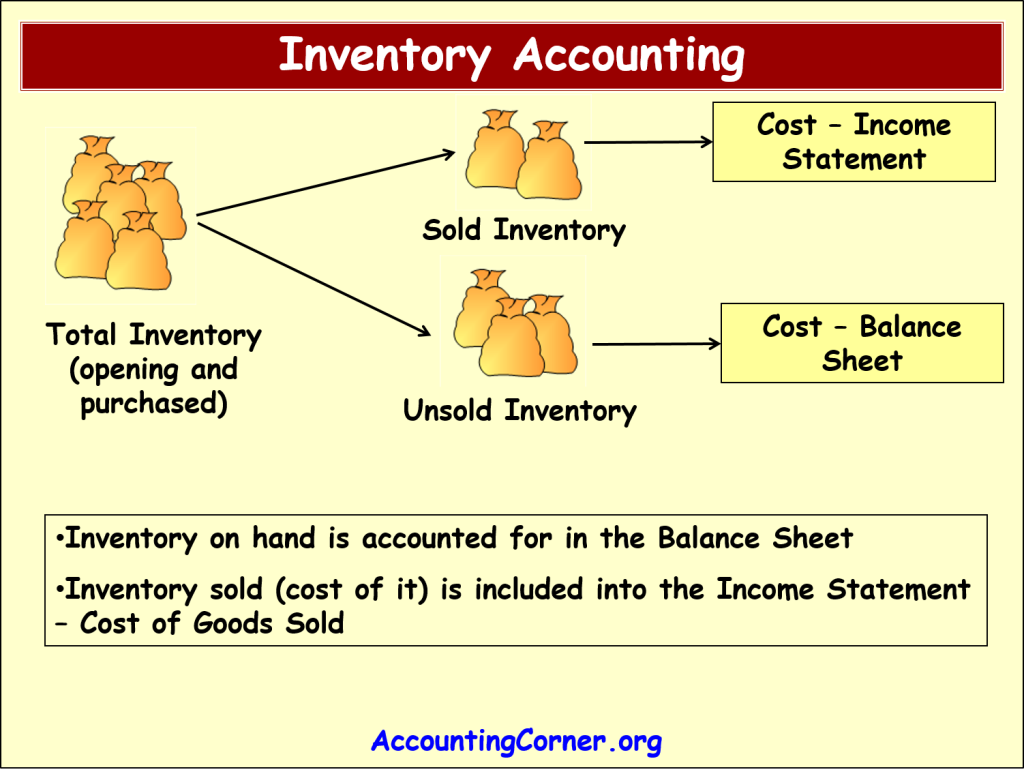

MarginEdge includes the Category Types Food, Beer, Wine, Liquor, NA Bev and Retail under COGS.Ĭategory Type Other falls under Expenses. It is also true that the restaurant needs to pay rent, utilities, labor, and repair and maintenance costs, but none of these are directly associated with the sale of a cheeseburger, but rather with the cost of operating the business generally. Expenses (also called Operation Expenses or Indirect Expenses) are the general cost of operating a business that are not tied to a particular sale.įor example, in order to sell a cheeseburger, a restaurant would need to buy the physical ingredients: buns, ground beef, cheese, etc…these would be considered Cost of Goods Sold. Expenses are anything needed and paid for to keep the business running, but that aren't directly. What is the difference between COGS and Expenses?Ĭost of Goods Sold is the direct cost required to produce any sales in a particular period. COGS is listed in the gross income section of the income statement, not in the expenses section. Operating Expenses Operating expenses and cost of goods sold (COGS) are both expenses that businesses spend in the course of doing business. This might be more easily expressed as follows:Ĭost of Goods Sold = Purchases + (Starting Inventory - Ending Inventory)ĬOGS = Purchases + Inventory Adjustments. View COGS.pdf from MBA BUSINESS E at IIT Bombay. This does not include general operating expenses of a restaurant not directly associated with specific sales.Ĭost of Goods Sold is a specific type account in a restaurant's general ledger, and it’s value can be calculated as follows:Ĭost of Goods Sold = Starting Inventory + Purchases - Ending Inventory Operating expenses refer to expenses that a business incurs through its normal operations, such as rent, office supplies, insurance, and advertising costs. This does not include products purchased during the period which were not used but remain in inventory.

This amount also includes products on hand that were used even if they weren’t purchased in the period. On the other hand, operating expenses are sub-ordinates of COGS as they are helping in profit generation, but the nature is indirect. If your company sells finished goods purchased from manufacturers, those purchasing costs are also included in your COGS. This is different from the total purchases over a period of time in a few key ways: Operating Expenses (OPEX) COGS are the costs that your business incurs to create and deliver your product or service. Meanwhile, operating costs represent the costs. For example in a pizza shop, the dough and toppings (sauce, cheese, pepperoni, etc.) are the COGS related to selling the pizza. COGS is an expense that is incurred because a sale takes place.

#Cogs vs operating expenses software

Cost of Goods Sold (COGS), also called Cost of Sales, refers to the direct costs of producing the goods sold by a Restaurant over a period of time. COGS reflect how much you spend on building and supporting the software services that your customers purchase. While the COGS (cost of goods sold) and OE (operating expenses) are both expenses but they are different.If you had no sales, you would basically have no COGS.

0 kommentar(er)

0 kommentar(er)